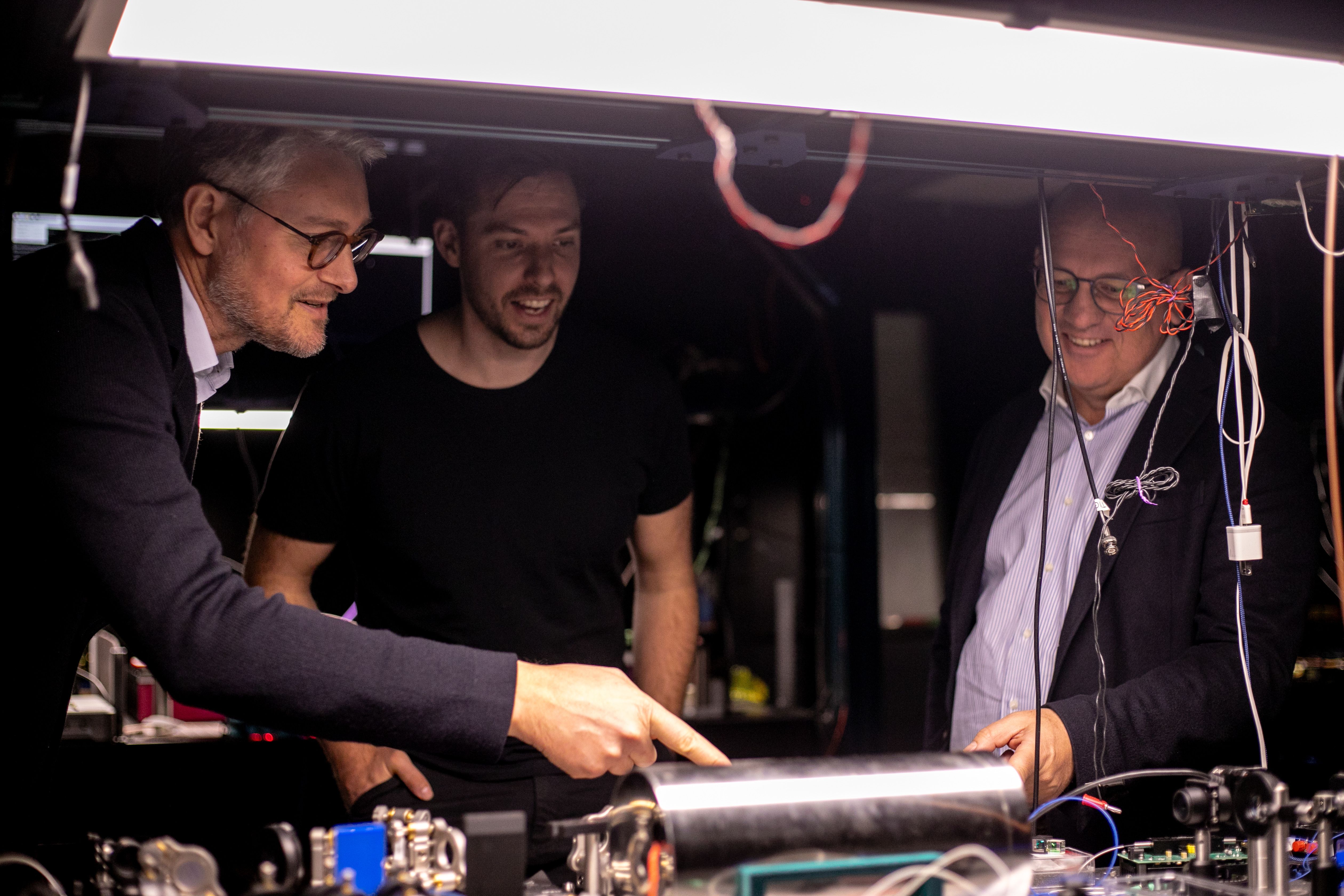

Olivier Tonneau, Will Zeng and Christophe Jurczak / Quantonation

Investment into quantum technology is surging, yet there are few VC funds solely focused on the sector.

Quantum computation, communication and sensing combined could generate up to $97bn in revenue worldwide over the next decade and Quantonation is set to help fuel that with the €220m close of its second fund.

The Paris-based early-stage VC fund investing in deep physics and quantum technologies has raised the largest ever quantum fund backed by Novo Nordisk, Toshiba and Vertex/Temasek, among others.

The European Investment Fund (EIF) also invested €30m into the fund, which is set to expand into advanced materials, sensing and next-generation computing.

“Quantum has spent decades being described as five years away,” said Quantonation co-founder and managing partner Christophe Jurczak. “That wasn’t a failure of physics, but of ecosystems. What’s changed is alignment: hardware, software, supply chains, and industrial demand. Quantum is no longer a race to build one machine. It’s an interlocking stack, and that’s where durable value now sits.”

Closing its second fund positions Quantonation as the largest dedicated quantum investment firm globally, by AUM. While generalist VC funds are increasingly looking into quantum companies, only a few are dedicated to them entirely.

The second largest quantum fund is 55North, which launched last October with the first close — €134m — of what is set to be a €300m fund.

The Denmark-headquartered VC has backed Finnish startup IQM as part of its €275m Series B and German Kiutra in its €10m Series A.

In London, “quantum-first” VC firm Firgun Ventures launched with its first close of $70m back in November. It aims to raise $250m. Similarly to Quantonation, it focuses on early-stage startups, and this week made its first investments into Los Angeles-based Quantum Elements and Canadian startup Photonic.

Quantonation has invested in companies across quantum computing, networking, sensing, materials, adjacent supply chain and broader deep-physics domains since launching in 2018.

To date, the first fund has invested in 27 companies worldwide, including Nord Qauntique, Multiverse Computing and Pasqal, which doubled down on its presence in Korea with a $52m investment last October, as Pathfounders exclusively revealed.

The second fund has invested in 12 companies so far, with expectations of building out a portfolio of around 25.

“With Quantonation I, our mission was to back the pioneers. These were the teams turning quantum physics into working machines, and to help the first leaders emerge,” Olivier Tonneau, Quantonation co-founder and partner, said. “With Quantonation II, the focus shifts to utility and scale: demonstrating practical advantage, building robust products, and preparing for industrialisation.”

Company info:

Headquartered: Paris, France and NYC, USA

Co-founders: Olivier Tonneau andChristophe Jurczak

Recent investments include: Diraq (quantum computing), Pioniq (advanced materials), Chiral Nano (nanomaterials), Qblox (supply chain) and Project11 (security)